Adjust has examined the state and performance of Latin America’s mobile gaming market in its latest report.

Latin America is one of the world’s fastest-growing mobile gaming markets, with the region’s inhabitants taking advantage of the relative affordability of phones compared to other gaming platforms and the increase in internet penetrations to get into gaming.

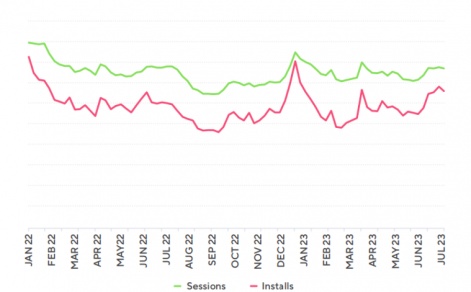

However, it appears that the market struggled somewhat following the so-called “Covid boom”. There were steady declines in both sessions and new installs, with a low point in both metrics in October 2022 and a peak in January 2023, before declining significantly.

The market does seem to be normalising somewhat, with a distinct upward trend. July 2023 saw a 22% increase in installs compared to October’s low point, while sessions also increased 11% over the same period.

Between H2 2022 and H1 2023, the entire LATAM region saw 7% growth in both sessions and installs. Chile was a clear standout in terms of installs, with a 35% rise. This was followed by Mexico, with a 14% increase over the same period.

While Chile reported the highest number of installs, it struggled somewhat in terms of sessions, with only a 5% increase - tied with Brazil for the lowest in the market. Adjust notes that “Chile’s installs boost, coupled with less impressive sessions growth, illustrates the importance of balancing re-engagment and retention with UA.”

Retention and session length

D1 retention throughout the region stands at 26%, just below the worldwide average of 29%. Argentina and Mexico saw the highest D1 retention rate at 28%, followed by Chile (27%), Colombia (26%), and Brazil (25%). By day 7, almost all countries throughout the region level out at 11%, with the exception of Brazil at 10%. Retention rates then decrease slowly, with Mexico leading the way on day 30 with a 6% retention rate, while other countries in the market stand at 3% or 4%.

In terms of session length, LATAM falls in line with the global trend by failing to bounce back to mid-pandemic levels. Average session length stands at around 26 minutes, with increases across the board compared to 2022, signalling slow but steady growth.

Colombia is identified as the country with the highest increase in 2023 so far, with the average rise in session length increasing from 27.12 minutes to 27.4 minutes. This marks the third consecutive year that Colombia has seen the highest average session length.

Last month, Adjust reported that Japan's consumer spend is set to exceed $12.6 billion in 2023.