It’s official: Squad Busters will be Supercell’s sixth global launch when it releases on May 29th.

By the time it rolls out, it will have been five and a half years since its last worldwide launch, with Brawl Stars going live back in December 2018.

It’s not for lack of trying - the developer has soft-launched a number of titles that ultimately failed to make the cut, including Clash Mini, Clash Quest, Hay Day Pop and Space Ape’s Boom Beach Frontlines. Supercell has stood firm of its mantra to only launch titles that it believes will stand the test of time - it’s $1 billion or bust.

Culture rethink

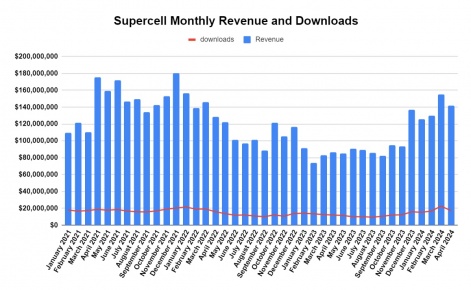

But last year, Supercell took stock of its position in the market. It was no longer at the top of the pile in mobile gaming, and its major titles had been in decline for years - except for a pandemic boost that drove up the entire market.

A restructure and review of its culture has led to a hiring spree and the introduction of new layers of management. For example, it hired former Mojang head of games Sara Bach as its head of live games as the company looks to reverse a portfolio in decline, while it has also developed a new internal system called Spark to get ideas greenlit for development.

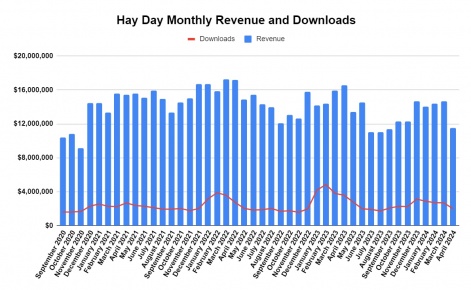

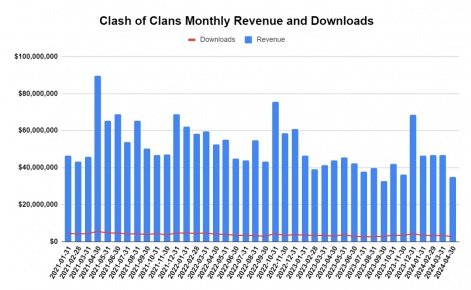

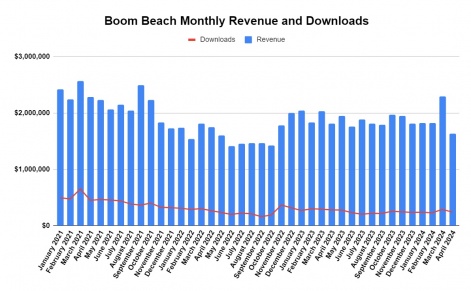

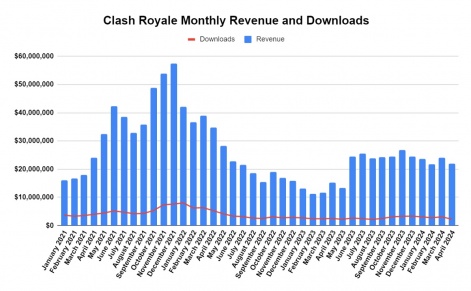

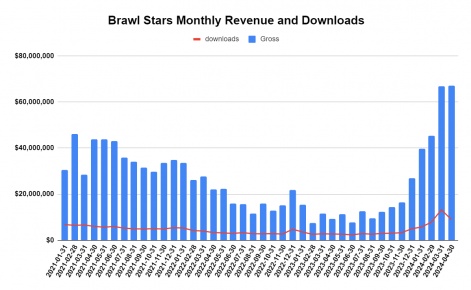

With Squad Busters on the horizon, has Supercell’s wider strategy started to bear fruit? Using AppMagic data estimates, PocketGamer.biz has analysed the performance of its existing titles Hay Day, Clash of Clans, Boom Beach, Clash Royale and Brawl Stars to see if the famous developer is getting back to its best.

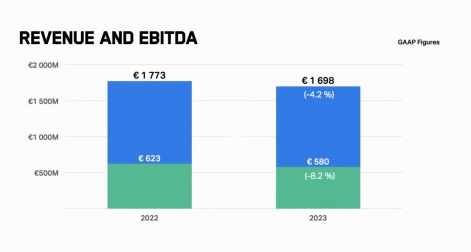

It’s important to note that the following data only includes revenue from the App Store and Google Play, and does not include data from third-party Android marketplaces or Supercell’s web shop. Some companies like Playtika have driven as much as 25% of their revenue (Q4 2023) from their direct-to-consumer platforms. Still, even Supercell’s own financials for 2023 showed a yearly decline in revenue and EBITDA.

Click here to view the list »